Probate Ancillary Administration

Florida Attorneys

Serving You and The State of Florida

If a decedent were living outside of Florida at the time of death, assets in Florida would have to pass through ancillary probate to reach the beneficiaries. Ancillary probate is common in states such as Florida, where real estate is often owned by those whose primary residence is in another state. Let the experts at the Lopez Law Group handle the ancillary administration of probate.

If the state where the individual resided has a probate administration, then ancillary probate in Florida can take place simultaneously. If probate administration did not happen in the state of residence, then the procedure in Florida will be non-domiciliary probate. The Lopez Law Group can work with out-of-state attorneys to simplify the ancillary probate administration process.

When is Ancillary Probate Administration Necessary in Flordia

Ancillary administration is governed by F.S. Section 734.102, which provides for nonresidents of the states who die and leave assets in the state that a personal representative designated in the decedent’s will can administer the property in Florida. Such ability to administer the property will be granted by ancillary letters issued by the court if the person is qualified to act in Florida.

Creditors located in Florida will need to file a claim in the domiciliary state of the decedent. It is possible for creditors to file a claim against an ancillary administration, but it is less likely to be successful. However, if the decedent owed money to creditors in Florida but did not own property, there is no need for ancillary probate administration.

F.S. 734.102 lists the different types of assets that require ancillary administration. There is real property, such as a house, condo, other real estate, or vehicles. There are less common types of assets that may require ancillary administration, including:

- Loans—a loan that is made in Florida is an asset of the estate, and ancillary administration is required to transfer the loan in accordance with the decedent’s will. If the individual died intestate, the intestacy statutes of the state of residency might require ancillary administration.

- The decedent owns a boat, mobile home, or recreational vehicle titled by the state of Florida.

Who Can Be Named an Ancillary Administrator in Florida?

Florida statutes set forth an order of preference for naming the ancillary administrator. The person named by the decedent’s will to administer the estate in Florida has first preference. If that person cannot or will not perform the duties, it will be the person appointed as the domiciliary personal representative, assuming they are qualified to serve in that capacity.

If neither of the two can perform the duty, the surviving spouse is typically given preference to act as the ancillary administrator.

Ancillary Probate in Florida

Ancillary probate administration follows the same procedure as a domiciliary estate in Florida, including bonds, notice to creditors, and the ability to sell the property and pay debts. The difference is that once the ancillary administration is concluded, the assets can be directly distributed to the beneficiaries or can be transferred to the domiciliary estate and administered there.

A personal representative given ancillary administration authority should speak with a Florida probate attorney about the best way to proceed with ancillary probate in Florida. The personal representative may need to post a bond and give notice to creditors. The Lopez Law group can represent the personal representative in the sale and distribution of real property as well as the sale and distribution of other personal assets.

To start ancillary administration, a Florida probate attorney will need the following documents:

- Two original death certificates for the court and real property

- Certified copies of the domiciliary proceedings, such as:

- The will

- Either the petition for probate or an affidavit that no petition was required

- The order admitting the will to probate

- All other relevant documentation of the domiciliary proceedings

Ancillary Probate for Property Worth Less than $50,000

F.S. Section 734.1025 makes it quicker and easier to sell and distribute assets that are worth less than $50,000. Documentation will need to be filed with the circuit court and proper notice given to creditors. If no creditors make a claim against the property, the personal representative can sell and distribute it. If creditors come forward with claims, there will have to be a resolution of the claims before the property can be distributed.

Can Ancillary Probate in Florida be Avoided

Ancillary probate in any state adds additional cost to the expense of settling an estate. Adding substantially to the cost is Florida Probate Rule 5.030, which requires that every guardian and personal representative unless they are the sole interested person, must be represented by an attorney that is admitted to practice in Florida.

Ancillary probate in Florida is only required if the estate meets the following criteria:

- The decedent was not a Florida resident at the time of his or her death, and

- Died owning property in Florida

A person could be considered a resident of Florida under Florida Statute § 222.17 if they resided in, maintained, and intended to maintain their principal home in Florida.

To avoid ancillary probate proceedings, an estate planning attorney should ensure that clients who are not Florida residents do not own outright any property in Florida. This can be accomplished through the establishment of trust that remains outside of probate. Some examples include:

- A Revocable Living Trust

- An Irrevocable Living Trust

- Land Trust

Talk to the Lopez Law Group about whether a trust is a right decision for you.

Florida Attorneys Specializing in Ancillary Administration of Probate

It is essential to do ancillary probate simultaneously with the main probate administration. If the Florida property is not probated simultaneously, it could result in reopening a resolved probate to transfer the property from Florida.

If you have a loved one that died in another state while owning assets in Florida, The Lopez Law Group can handle the Florida ancillary portion of the estate. Contact us today for a case review at (727) 933-0015. We will work with out-of-state probate attorneys to ensure that the ancillary administration is done efficiently and in accordance with Florida law.

Practice Areas

What Our Clients Say

A Godsend

Mr. Lopez was a Godsend and really helped me with my situation. Him and the entire firm were very diligent and helped speed the early stages of the process along due to a pressing situation. Throughout my experience working with the firm, they were always responsive and available any time I had a question or wanted to check on the state of affairs. Hopefully I won’t have to recommend Lopez Law Group to my friends or family, but if those unfortunate circumstances arise then there’s only one name I would trust. Thank you again for all your help!

Lopez Law Group Can See You Through Cases Like:

Don't See What You Need?

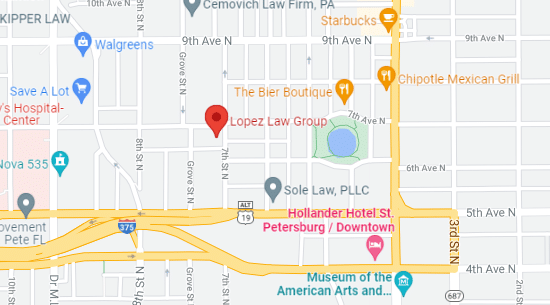

Lopez Law Group

700 7th Ave N, Suite A,

St. Petersburg, FL 33701

P: 727-933-0015

Business Hours

Mo, Tu, We, Th, Fr

Schedule a Call Back

Book a Consultation