Hail and Roof Damage Claims in Florida

Florida Attorneys

Serving You and The State of Florida

Hail can cause significant damage to roofing materials. Florida is no stranger to severe weather, and there are many kinds of storm damage that homeowners need to be prepared to deal with when they own property in this state.

If you have never had to submit a hail or roof damage claim in the state of Florida, this primer will be a big help to you. Knowing more about the process of submitting a roof damage claim can make it much easier to get your home repaired and back to its former state after hail damage.

Understanding Roof Coverage on Your Policy

The first thing that homeowners need to be aware of are the limitations and protections that are offered on their homeowner’s insurance for roof damage. Roof coverage does not take into consideration the age of your roof at the time of the damage. Roof coverage is also not intended to be used to upgrade your roof to a much more expensive roofing style during the repair process.

In order to use your roof coverage, you need to be able to prove that the damage was related to hail or a storm. You cannot use this coverage to repair a leaking roof or to replace a roof that is aging. Your roof coverage under your insurance policy is solely to be used for catastrophic damage related to weather or large items falling on your house.

You might also be able to claim any damage that happens to the items and interior surfaces of your home related to hail damage or storm damage. Once again, this requires an investigation into the reasons that the roof was damaged in order to be able to claim damages to the interior of your home.

Roofing that protects a garage or an outbuilding might not be covered under the same portion of your homeowner’s insurance as the roof on the main residence. Different insurance companies handle these kinds of claims in unique ways. You might need to inquire about this part of the language of your homeowner’s policy so that you can be clear about what to do if an outbuilding or shed is damaged by hail.

The Difference Between RCV and ACV

RCV is replacement cost value coverage, and ACV is actual cash value coverage. RCV coverage will not take into consideration the depreciation of your roof and will just pay the replacement cost minus your deductible. ACV coverage subtracts the depreciation amount from the replacement cost and pays out the difference minus your deductible.

In some cases, ACV coverage does not pay enough for homeowners to repair their roof. This can be one of the reasons that someone might need to secure a lawyer to help with their case. If you believe that you are not being paid the fair amount for your roof replacement costs minus depreciation, a skilled legal expert can help.

Insurance companies tend to offer settlements and claims payouts that are quite low. You have the right to appeal these payment decisions, but it is often easier to get help from a legal expert to undertake this process.

What is my Deductible?

All homeowner’s insurance policies have a deductible that must be paid by the homeowner in order to file a claim. This is the co-insurance that is necessary for the insurance company to be able to remain in business while caring for claims all over the US. The deductible will usually simply be deducted from the amount that you are paid on your claim to repair or replace your roof.

If the estimate for your roofing damage is in excess of the cost of your policy’s deductible, it might be time to file a homeowner’s insurance claim for hail damage to your roof. Be aware that your homeowner’s policy cost will likely go up for a few years after you make a claim on your insurance. You need to be aware of this factor before you decide that it is worth it to make a claim against your policy.

Can my Claim be Denied?

Insurance companies can deny claims for a variety of reasons. If you have not been able to prove that the damage to your home was caused by hail, your claim could be denied. There are other reasons that this kind of judgment might be passed on your claim, typically related to suspected fraud or unclear information in the details of your claim.

Many people fail to respond to requests from their insurance company for additional information related to their claim or personal information that was not given when the claim was filed. These kinds of denials can often be appealed, and the missing information can be provided so that the claim can be processed again.

Can my Claim be Undervalued?

In some cases, insurance companies can undervalue the cost of repairs that are needed to repair or replace your roof. This can happen for a variety of reasons, but these decisions can often be appealed. The process of appealing an undervalued claim decision is much easier with a lawyer working on your behalf.

You might need to pay for another estimate for the cost of replacing or repairing your roof in order to pursue an appeal of this kind of claims decision. While paying for a third-party expert to look at your roof can seem like just one more cost, it can be worth it if your claims payout comes in well below the amount needed to repair or replace your roof.

Do I Need an Estimate of the Damages to File a Claim?

You can open a claim without an estimate in hand, but you will still need to have an estimate done before the claim can be processed. There are various ways to get an estimate of the damages to your home related to hail. Most people opt to have the roofing company that is going to do the repairs provide an estimate of the cost of the damages, which can be passed on to the insurance company.

In other cases, it is possible to have the emergency disaster company that came to your home provide an estimate of the roofing damage related to the claim. These companies are often equipped to check out the nature and extent of the damage as they are protecting the roof from moisture and removing items like tree limbs or debris that might have damaged your roof.

The insurance company will need to send out a claims adjustor in most cases to verify that the damage to the property that you have reported is consistent with the estimate. This can take a few weeks in some cases, especially if there have been lots of homes damaged by the same storm. The sooner that you are able to provide an accurate estimate to the insurance company, the better.

How Are Claims for Roof Damage Paid in Florida?

In many cases, the insurance company will provide the claims settlement amount to the homeowner directly. You will then use this money to pay for your new roof. If the insurance company that you have a policy with has preferred service providers who offer roofing services, however, the cost for the roof repair might be paid directly to the roofing company instead.

Typically, you will be asked about this detail of the claims process and be allowed to select which kind of payment process you would prefer. If you have additional damages to your home related to hail damage that is being paid out by the insurance company, you will probably only be offered a lump sum payment option.

Can I Get Payment for Water Damage as Well as Hail Damage?

If the interior of your home has been damaged due to the hailstorm that damaged the roof, you might be able to include this information in your hail damage claim. Water damage is common when roofing on homes fails. Many insurance companies expect to have to pay out on water damage along with hail damage after a storm.

You can check on this detail in your specific policy by reading the policy documentation that you were sent when you bound your policy. If you are not certain after you have looked at the policy language included in this documentation, your local agent should be able to offer you advice about this part of your policy’s coverage.

Get Help With Your Denied Claim

If your insurance claim has been denied and you believe that it should not have been, you can reach out to a skilled legal expert for support. The team at Lopez Law can help you to appeal your insurance claim for hail damage. Being denied the coverage that you have paid for can be very frustrating, and it might cause you to be unable to repair your home. We have the skill and attention to detail that you need to get access to when fighting insurance companies for proper claims payments.

Related:

Practice Areas

What Our Clients Say

A Godsend

Mr. Lopez was a Godsend and really helped me with my situation. Him and the entire firm were very diligent and helped speed the early stages of the process along due to a pressing situation. Throughout my experience working with the firm, they were always responsive and available any time I had a question or wanted to check on the state of affairs. Hopefully I won’t have to recommend Lopez Law Group to my friends or family, but if those unfortunate circumstances arise then there’s only one name I would trust. Thank you again for all your help!

Lopez Law Group Can See You Through Cases Like:

Don't See What You Need?

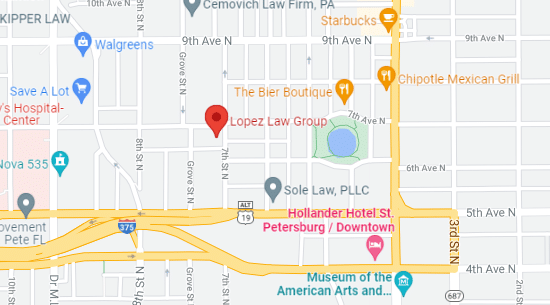

Lopez Law Group

700 7th Ave N, Suite A,

St. Petersburg, FL 33701

P: 727-933-0015

Business Hours

Mo, Tu, We, Th, Fr

Schedule a Call Back

Book a Consultation