Misclassification as Exempt Law in Florida for Employers

Florida Attorneys

Serving You and The State of Florida

Not every person that a business hires will be eligible for overtime. There are exempt laws that guide the selection of who qualifies for this status in the state of Florida that you might need to be aware of. You should make sure as well that your HR team knows which employees need to be classified as exempt so that you do not run into issues with paying your taxes and with lawsuits related to incorrect pay.

Florida employers should be sure that they have the right kind of legal support in their corner when it comes to misclassification lawsuits. The team at Lopez Law Group can help you with your misclassification case to ensure that you do not end up paying for overtime hours that an employee is not due and to protect your business’ reputation.

Statutes That Govern Misclassification as Exempt Laws

In most cases, hourly workers are entitled to one and one-half times their regular rate of pay when they are working hours outside of a 40-hour work week. FLSA (Fair Labor Standards Act) laws might state that certain positions or kinds of work are exempt from this rule. This is usually the guideline that helps to determine which positions at a company are paid without consideration of overtime. As a general rule of thumb, all full-time hourly employees who have worked more than 40 hours in a week will need to be paid overtime pay for the hours that they accumulated beyond their normal 40 hours.

It is possible to misclassify a staff member on either side of the FLSA-stated standards. Your HR team might have classified someone as being eligible for overtime pay that they actually should not have received, or it is possible that team members have been classified as exempt, but they are actually due the overtime pay that they earned while working for your Florida business.

FLSA law will require that a remedy is made in either direction related to incorrect pay. This can become quite costly to employers who have discovered that staff was not being paid overtime that they were entitled to. Additionally, businesses that are embroiled in disputes over the rate of pay or salary compensation that is owed to their staff can be impacted by negative public opinion and reputation. This is the kind of dispute that every business owner wants to avoid, and for good reason.

Kinds of Exemptions for Unpaid Overtime Compensation

There are various kinds of exemptions that might apply to your staff. Many companies do not employ experienced HR staff to manage these determinations, which can lead to problems with staff compensation over the course of months and years. In addition, these laws can change over time, leading to mistakes related to HR staff being unaware of updates to the exempt pay laws.

Job roles in sales and management are often areas where determining the exempt status of an employee is difficult. There are also industries that offer largely remote positions that should not be paid overtime due to the related working hours and job demands. Compensation schedules and job role assignments might need to change over time as well, leading to staff who have not been informed of a change in pay correctly.

Executive Exemption

This exemption applies to overtime pay when the staff person is working in a management role for at least part of the time. This person must be managing at least two full-time employees or the equivalent of two full-time employees. This person must also have hiring authority within their job role. When these factors are present, the person is not allowed to receive overtime pay for their working hours at your business.

These kinds of part-time management positions are not common to many industries, but there can be crossover positions within manufacturing and industry that are impacted by this kind of misclassification. This is also a common trouble area for smaller businesses that have to hire a small staff who end up wearing many hats all day long at work. It is always wise to avoid creating these kinds of hybrid positions at your Florida business, but if you need to create these job roles, you must be sure that they are paid correctly.

Administrative Exemption

This overtime exemption requires that the staff person in question does office work related to the core business operation and that they have discretion related to important matters that concern the business. This will not be a staff person that is engaged in non-manual tasks or in other administrative duties. The person that qualifies for this exemption will need to be proven to actually be engaged in company operations and management at least part of the time.

Professional Exemption

This exemption type has two categories. The first is the learned professional, which requires that job duties make use of advanced knowledge or skilled training. The other possible type within this category is the creative professional whose job must be related to imagination, talent, or original thinking that is used in a creative field of some kind. It is likely already clear that this kind of job role can be very easy to classify incorrectly, and it can also be really common for staff to believe that they are not being compensated correctly according to the kind of work that they do.

Computer Exemption

For this exemption to apply, the worker must be a computer systems analyst of some kind or must be a programmer or engineer who works on computers or computer-related processes. This only relates to high-level staff with specific training and does not apply to the technical staff that handles help desk calls or has basic interactions with devices. This exemption is most commonly applied to coders and computer programmers who often work long hours and at odd times of day without a regularly-recurring assigned shift.

Outside Sales Exemption

Outside sales jobs are usually transaction-based tasks, and these staff members typically work remotely or away from the office while engaged in their job duties. There is no minimum weekly salary that is laid out for this kind of role, which is a notable departure from the requirements of other FLSA jobs. This is because of commission payments within this job role.

This is a very commonly misclassified job, and mistakes can be made on both sides of this profession. It can be easy to mistakenly classify sales staff as being exempt due only to them traveling frequently for their job. It is also possible that someone might not be correctly placed in this class because they are not working remotely as often as the HR staff people think they should be to qualify.

There are other classifications within common professions that might also qualify as exempt positions, depending upon the level of skill and the management tasks that a job is assigned. Knowing how to assign employees with regard to Florida exempt laws can require years of experience in this kind of HR space. Many companies do not have skilled and experienced HR staff members to make these determinations, leading to problems with lawsuits and other misunderstandings.

What Can Employees Do if They Think They Have Been Misclassified?

Staff who think that they have been misclassified are entitled to seek up the three years of back overtime pay. This usually only applies in situations where the job is clearly defined via FLSA overtime requirements, but there can be complexities that allow staff to seek overtime pay even when an employer’s job definition classifies their job role correctly per the FLSA laws.

This is why it is so important to have a skilled legal team working on your exemption law cases. These kinds of laws can be quite complicated, and there is often quite a bit of research that is needed to verify the correct status of the person who has brought a lawsuit against your Florida business. Business owners might be tempted to think that just paying the back pay is the easiest way out of a tough spot, but that is not always necessary.

Working With a Skilled Legal Team Matters

The team of employment lawyers at Lopez Law Group will take the time to research the situation related to the lawsuit and ensure that your business does not suffer lost reputation and does not have to offer back pay to staff who are not entitled to the money they have asked for. Our team has the skill to verify the details and the complexities of these laws to ensure that your case gets a favorable outcome. If no settlement can be reached, our skilled lawyers will be happy to present your case to a judge as well.

Working with a skilled legal team can make all the difference in the outcome of your exempt pay cases. You should not try to go it alone with legal issues this complex. Contact us today to set up a consultation, and let us represent your Florida business with skill and attention to detail.

See Also:

Practice Areas

- Business Lawyers

- Residential Real Estate Lawyers

- Commercial Real Estate Lawyers

- DUI Lawyers in Florida

- Expunction and Sealing Lawyers

- Florida Clemency

- Injunction Lawyers

- Tenant Lawyers

- Landlord Lawyers

- HOA Lawyers

- Defamation Lawyers

- Eviction Attorneys

- Moving Company Dispute Lawyers

- Probate Lawyers in Florida

What Our Clients Say

A Godsend

Mr. Lopez was a Godsend and really helped me with my situation. Him and the entire firm were very diligent and helped speed the early stages of the process along due to a pressing situation. Throughout my experience working with the firm, they were always responsive and available any time I had a question or wanted to check on the state of affairs. Hopefully I won’t have to recommend Lopez Law Group to my friends or family, but if those unfortunate circumstances arise then there’s only one name I would trust. Thank you again for all your help!

Lopez Law Group Can See You Through Cases Like:

Don't See What You Need?

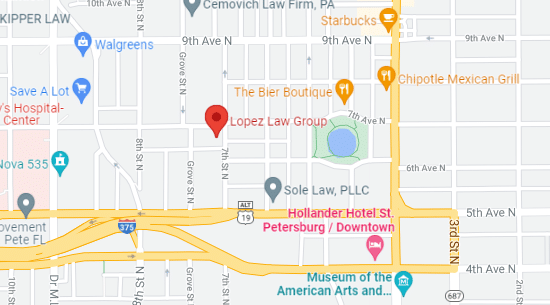

Lopez Law Group

700 7th Ave N, Suite A,

St. Petersburg, FL 33701

P: 727-933-0015

Business Hours

Mo, Tu, We, Th, Fr

Schedule a Call Back

Book a Consultation